Financing Window Treatments In Cleveland

Sunburst Financing FAQs

Why should I finance my shutters instead of paying with cash or credit?

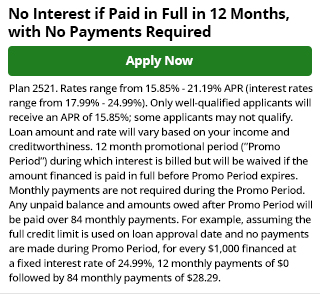

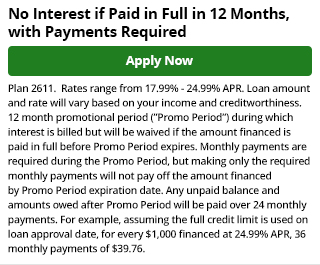

Financing your shutter project lets you save both your money and your equity, and typically comes with a more affordable interest rate than a credit card. GreenSky has multiple options with deferred interest benefits, but without you having to pay out of pocket all at once.

What kind of credit is available?

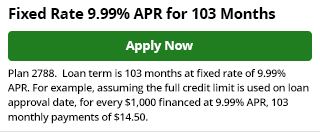

GreenSky loans are unsecured loans with fixed interest rates. Unlike credit with non-fixed rates, your payment is always the same.

How do I make payments?

It’s simple – you can pay online or by phone, or set up automatic payments to be drafted from your bank account. It’s up to you. And there is no drawback to paying off your loan before the term ends.

How do I pay my shutter installer?

Once approved, you’ll be given a loan agreement as well as a 16-digit account number with an expiration date. To pay Sunburst, just provide these numbers to your contractor as you normally would with a credit card.

What’s the time limit on using my loan?

After approval, your purchases must be made within 4 months.

When does the payment period start?

Depends on your plan. Some deferred interest plans don’t require a payment during the promotional period. The first payment on a budget-minded plan is typically due approximately 30 days after the first purchase.

When does the Deferred Interest plan promotional window begin?

After your first transaction.